Today’s digital economy is very competitive in almost every industry. You risk confusing, irritating, and potentially losing your clients if you do not create an effective and fast onboarding process that is simple to follow. Your successful onboarding process should ensure a quick and efficient onboarding process, allowing you to onboard new clients more quickly and at a higher volume.

To really assure complete KYC compliance, it is critical to collect as much relevant data as possible. Know your customer (KYC) or know your business (KYB) practices are intended to improve the efficacy of good risk management and fraud prevention, as well as to strengthen overall security and assure compliance with AML and CFT regulations.

What Is KYC in Client Onboarding process?

KYC (know your customer) is the procedure by which banks or other financial organizations collect information about their clients and authenticate it by comparing it to a vast variety of public information lists and databases. Anti-Money Laundering (AML) and Customer Due Diligence (CDD) are two more critical steps that work via KYC and involve frequent assessments and continuous customer monitoring.

Analyzing the possibility of illegal activity and avoiding the misappropriation of company services through identity theft, money laundering, terrorism funding, and fraudulent financial transactions are the main goals of this operation

KYC can be done either online or offline. The customer downloads the onboarding application, fills out the contents of a real form, signs it, and sends it along with a copy of the required documents in the KYC offline channel. However, through the online channel, the client uploads the necessary documents and fills out the required info in the online form. Manual inspectors verify these papers and communicate with the customer to finish the procedure.

Traditional Client Onboarding And Its Challenges

Traditional KYC methods rely on humans who perform manual tasks such as data sorting, data entry, error correction, and verification. Because of this reliance on human resources, banks have several challenges in onboarding new clients and maintaining regulatory compliance.

With a complex and ever-changing regulatory landscape, maintaining compliance in customer onboarding may be a difficult task for financial institutions. Banks must fulfill regulatory criteria imposed by local, regional, and national governments, as well as provide a comfortable onboarding experience for clients, all while being financially sound. When adopting conventional KYC, institutions have various challenges:

Manual data entry in Client Onboarding process

The majority of institutions’ onboarding processes necessitate the gathering of data, which is still done via paper and email. This necessitates a massive quantity of labor-intensive, manual effort, which leads to mistakes and additional expenditures.

Expensive

Major financial institutions have claimed annual KYC/AML and due diligence expenses ranging from $50 million to $500 million.

Internal salary wages, third-party identity verification, technology development or third-party licensing, regulatory fines, and remediation expenditures all contribute to the actual cost of KYC. It’s no surprise that banks are rushing to discover methods to make onboarding easier.

Time-Consuming

Internal teams devote hours to manual data input, information verification, error correction, and contacting consumers for further information. Due to the manual nature of KYC, firms might spend up to a month on KYC compliance for a single customer.

Customer Dissatisfaction

Due to the time-consuming nature of KYC, some clients may be onboarded for weeks, if not more than a month to provide more information clients may be contacted eight to ten times on average throughout onboarding. In reality, up to 40% of a bank’s potential customers are lost during the time-consuming onboarding process.

Security

With the post-financial-crisis adoption of GDPR, financial institutions must comply with rigorous rules regarding the handling and preservation of client data. Non-compliant banks face significant fines for data breaches.

With KYC costs on the rise, financial institutions are under pressure to minimize the compliance burden. As a result, banks are looking to technology solutions to automate these procedures and ease the burden of onboarding compliance.

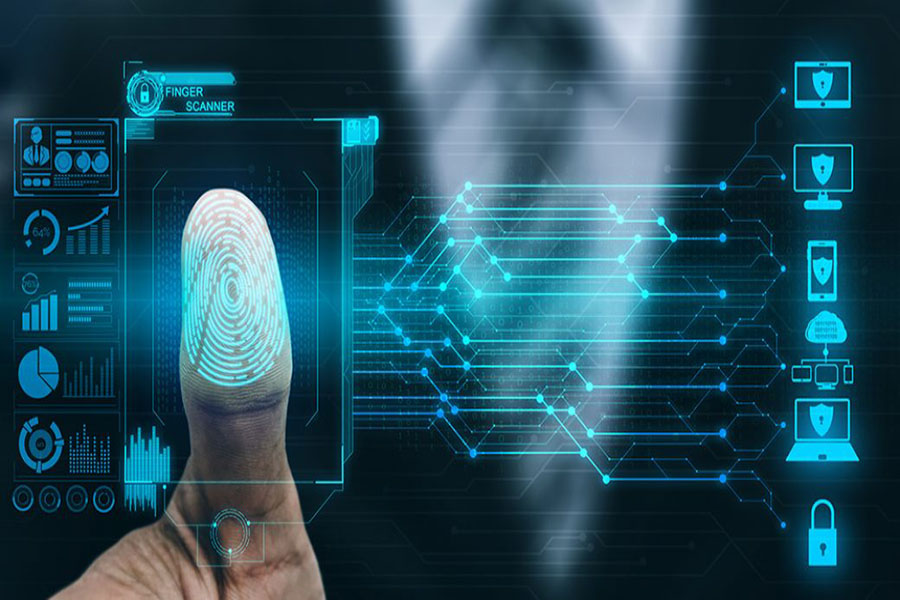

What Is Automated KYC Verification?

Automated KYC verification makes use of powerful artificial intelligence and machine learning technology to verify that your clients fulfill regulatory requirements without relying heavily on internal personnel.

Although end-to-end KYC processing still need people making high-level judgments, a large portion of the footwork may be delegated to automation, especially Intelligent Process Automation. Intelligent Process Automation (IPA) is a set of technologies that work together to manage, automate, and integrate digital processes. IPA’s technology includes the following:

- Robotic Process Automation (RPA) — The employment of robots capable of mimicking human behavior to perform high-volume, repetitive activities.

- Intelligent Document Processing (IDP) – A form of IPA that processes and extracts data from a huge number of documents using technologies such as machine learning, Natural Language Processing (NLP), and Intelligent Character Recognition (ICR).

- Artificial Intelligence (AI) – AI analyzes data in ways that humans cannot, identifying patterns and learning from prior decisions to make increasingly smarter conclusions.

Benefits Of Automated Client Onboarding

The use of IPA and machine learning to collect and analyze data can offer financial organizations with a more robust and immediate image of every client. This offers several short-term and long-term advantages.

Cost Savings

Using automated technologies to improve KYC procedures may save onboarding expenses by 70%. Banks may considerably cut costs by reducing data-entry error and correction, avoiding costly non-compliance fines, and accelerating the onboarding cycle.

Enhanced Efficiency

Customers may build a certified digital identity that can be validated instantly with fully automated identity verification. Because robots do not need to relax, automated systems may operate 24 hours a day, seven days a week with no downtime.

This reduces onboarding time by up to 80% and enables financial institutions to increase the overall number of customers onboarded.

Read more about How Does Identity Verification with AI Work?

Risk has been reduced

You can reduce the risk of mistakes caused by data input errors or oversights by automating end-to-end procedures. Reduced manual involvement also minimizes security concerns and data breaches, keeping consumers’ data secure and banks compliant.

Improved Customer Service

Customer happiness is essential for success. By avoiding the frequent back-and-forth between the consumer and the bank when new information is necessary, automated KYC delivers a seamless experience for clients. An automated procedure provides consumers with a simple and rapid accreditation or identification experience, resulting in faster account opening.

Scalability

Manual procedures are unable to expand without incurring significant labor expenses, and they are difficult to adjust to the rapid changes in KYC laws, internal changes, or external threats.

AI-powered bots operate 24 hours a day, react fast to external demands, and can be incorporated into your company’s infrastructure with little to no disruption or downtime.

Conclusion

In a highly regulated business, onboarding new clients can be difficult. Fortunately, technological advancements are enabling financial institutions to deploy automated solutions that provide a plethora of benefits at a fraction of the expense of traditional methods.

KYC automation, when done effectively, may help your organization save money, increase efficiency, free up human resources, and maintain regulatory compliance.

For more information about our Digital Identity Verification services click on the link.